Debit notes and credit notes are an integral part of all sales and purchase transactions in the B2B system. Also referred to as debit and credit memos, they correspond to debit and credit entries in accounting logs, serving as proof of a specific business deal. A buyer raises a debit note when goods are returned to the seller, and in response, the seller submits a credit note. There are various scenarios when issuing credit and debit notes saves time and hassle for both purchasers and sellers, making them a popular form of billing.

The meet and greet

Emma Smith, 35, is the Chief Accountant at a local food-processing facility. Expert at number crunching and managerial accounting, she is adept at ensuring the accuracy of financial and accounting records. She always ensures accurate entries in asset, liability, and capital accounts, which saves thousands of dollars for her company.

Being a manufacturer of perishable goods, her company has to consider and track the sales and purchase returns from both its clients and suppliers. As Ms. Smith is in charge of accounts payable and accounts receivable, she has to deal with credit and debit notes on a daily basis.

To avoid excess remission in response to the claims from the purchasers, Ms. Smith focuses on creating accurate credit notes. She also works closely with her company’s purchase department to issue debit notes when purchased goods have to be returned to the suppliers.

Ms. Smith follows a routine where she checks with the supply department on the list of goods that have been returned by the purchasers. Similarly, she also checks with purchase departments for items that have been returned by the purchasers. She has to ensure accurate entries for each transaction to raise the credit and debit notes accordingly. Remaining vigilant on the entries’ accuracy is essential as both the credit and debit notes are created manually by her team. Having to draft them from scratch adds to the hassle.

Managers and investors alike must understand that accounting numbers are the beginning, not the end, of business valuation.

– Warren Buffet

What are the essential finance & accounting documents?

An expert in handling finance and accounts, Ms. Smith, puts a special effort into managing crucial documents. While there are as many as 10 essential documents associated with the Finance and Accounting process, she accentuates credit and debit notes.

What is a debit note, and why is it important?

When the buyer has to return goods to the seller due to some reason, he sends a debit note as intimation. The note informs the seller about the amount and quantity of the goods being returned and also acts as proof of request to repay the extra money. Prepared like a regular invoice, it shows a positive amount.

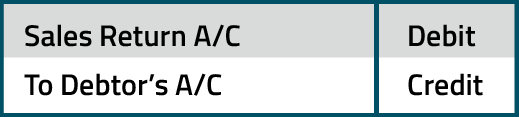

The journal entry to record a debit note in the books of the seller is:

What are the reasons for raising the debit note?

The following are some of the common scenarios to raise a debit note:

- Goods received are faulty or damaged

- The buyer no longer requires the goods and wants to cancel the purchase order.

- Incorrect invoice (buyer is overcharged)

What is a credit note, and what makes it essential?

On receiving the buyer’s returned goods, the seller has to prepare a credit note in response to his debit note. It serves as proof about the exact amount of money being repaid. Sometimes it also acts as an intimation to the buyer if the returned goods are found incomplete or incorrect.

A credit note generally shows a negative amount, and the journal entry to record it in the buyer’s books is:

What are the challenges in creating a debit and credit note?

- Manual errors: Inaccuracies in creating credit not can lead to overpayments and payments for goods that shouldn’t have been paid.

- Double payments: Sometimes, the buyers can send a second debit note if they don’t respond to the first one. With two copies floating around, it is easy to pay them both accidentally.

- Slow processing: Manual processing of debit notes consumes a huge amount of time. When a debit note for a particular invoice gets delayed, the seller can deny it entirely by calling the invoice obsolete.

- Insufficient storage: When your company has to create and store multiple accounting documents almost every day, the storage and retrieval issues are sure to haunt you.

Key Elements of Credit and Debit Note

- Business details: It includes the company name, address, phone number, and email address.

- Tax registration number: The unique Tax registration number must be mentioned.

- Receiver’s details: It includes the customer’s name and address. In case of a debit note, it consists of the supplier details

- Unique Id number: This must be unique and must follow on from the last credit/debit note.

- Account number: The account is the company’s reference for their customer/supplier

- Date and reference number: It relates to the purchase order and the delivery note

- Description of goods returned: Includes the unit price, quantity, tax, and rate of discount.

- Explanation: The note has to explain why a credit/debit note has been issued

What are the challenges of managing a/c receivable & a/c payable?

Having years of experience with collections, Ms. Smith knows the importance of creating and sending invoices on time. She works hard on streamlining the a/c receivable process as she strongly believes that the easier it is for the clients to pay, the more often they will. Equally competent in managing the a/c payable, she is fully aware of the risk of losing big bucks due to invoicing inefficiencies. On a broader level, having all the finance and accounting documents ready is part of her work regime.

How are you managing your current documentation?

When it comes to financing and accounting documents, Ms. Smith follows the outdated method of drafting and getting them signed manually. She then makes multiple copies and stores the original agreement in the filing cabinet. With no automation, even the copying of information from emails and messages is done manually. Obtaining the data from emails and even from phone calls ends up increasing the processing time significantly and hampers her work big time.

Here’s how she finally got it right with Revv –

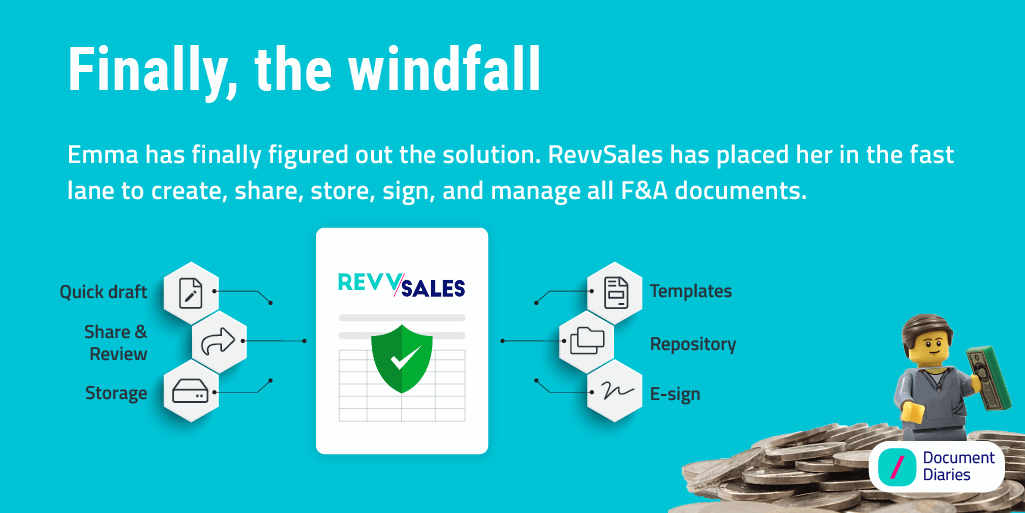

With a document management tool, she has gone about optimizing the entire a/c receivable and a/c payable system process. Her new ways involve:

The Revv way

- Choosing the template for the credit and debit notes from Revv’s repository

- Editing and personalizing the document for a specific invoice with the easy-to-use editor making it much easier

- Use the spreadsheet integration tool to update the price and quantity components. She can link Google sheets to bring in the tables directly into the document

- Send for approvals from the higher-authority

- Share the completed documents directly from the tool and get them e-signed

- Track the activity on the document via the Activity and Status bar. This gives her an overview of the bottlenecks, along with the real-time info on email and e-sign status, right from the document itself

- Store the signed document in a centralized repository for future updates, reviews, and reference

Her decision to invest in the document management tool has paid off. She and her team members are now able to draft and share multiple accounting documents with ease. The safe and easy e-signature has made the enormous task of ratification a matter of a few clicks. She can now secure all her documents in one place, which has significantly reduced access and retrieval time. Furthermore, the centralized repository enables her team to be better prepared for audits and monthly reviews.

Want to emulate Ms. Smith’s success with Revv? Check out our templates here.